The ECommerce market is growing as you’re reading this and the complexities of online financial transactions are endless. ECommerce businesses often grapple with challenges such as efficient sales tracking, sophisticated inventory management and handling multi-currency operations all of which are critical for maintaining profitability and compliance.

This blog is curated to guide you, as a potential ECommerce business owner or an ECommerce owner who is ready to put their plan into action, through the entanglement of various accounting software solutions which can meet your demands.

What Are Small Business CFO Services?

Firstly, the operations of an ECommerce business are really different from what you would expect a regular walk in, walk out retailer/business. Your ECommerce business has unique needs due to its digital nature. It’s going to require dynamic accounting solutions that’s going to handle multiple, rapid transactions and intricate data tracking. Your accounting will go hand in hand with the rest of the operations so having the correct accounting software will allow for easy integration capabilities in order to streamline effective operations. Lastly, human error is something we can never beat ourselves over so the really cool feature of accounting softwares is the automation features which can be used to detect errors thereby reducing the amount of errors inputted. It can also save you time on certain tasks like inventory tracking, calculating taxes and generating financial reporting.with ease.

The Top 10 Accounting Software Solutions

Below are a list of suggestions of accounting software solutions you can use for your ECommerce business. These are in no particular order:

QuickBooks Online

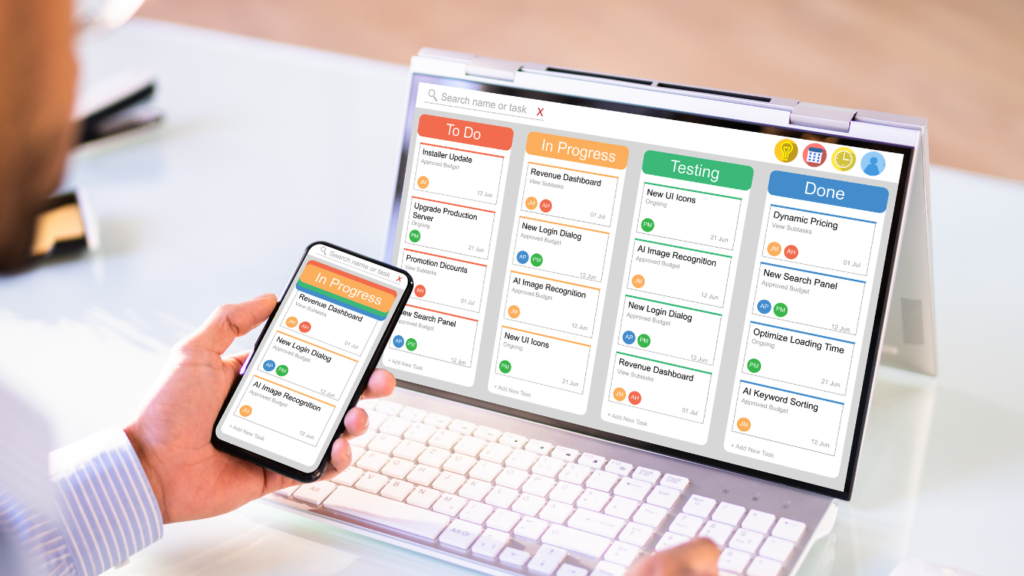

QuickBooks Online or QBO is the market’s popular choice that has robust features which can meet the needs of all small to medium sized businesses. Known for its user-friendly interface that is intuitive and easy to navigate, QBO offers comprehensive features like invoicing, expense tracking, payroll and tax management. It is also easily scalable and allows for third party application integrations and an add bonus of having a mobile app feature which can let you process and view information on the go! There are noted downsides to Quickbooks Online like the cost factor. Although it can be scaled for larger firms, the cost to operate and maintain is far greater than expected. There have also been some mixed reviews regarding the customer support and it’s highly recommended to have some insight as this accounting software may not be beginner friendly and requires some learning curve. QBO is highly recommended for the integration of ECommerce platforms like Shopify, WooCommerce, Amazon, eBay and other popular ECommerce platforms. The integration also features sync sales data, manage inventory and automate bookkeeping tasks. QBO offers comprehensive reporting that will allow the user detailed reporting and dashboards

FreshBooks

FreshBooks is aimed at the small businesses that work on a cloud-based storage so you can access the books wherever, whenever. Features include invoicing, account payables, expense tracking, purchase orders, fixed asset depreciation and many more industry standard-business and management features. With a friendly, clean user interface, customer support and mobile support feature, FreshBooks also offers a free API to integrate external applications. The cons to using Freshbooks is that it’s quite limited to its features and is not scalable. It also has various tier plans so in order to use the advanced features, you’ll have to pay a higher amount. Freshbooks is known to integrate with Shopify, Stripe, and PayPal to name a few.

NetSuite Inc (Oracle Netsuite)

NetSuite, owned by Oracle, is a comprehensive enterprise resource planning (ERP) software that includes powerful accounting capabilities. This platform is designed to support the diverse needs of growing businesses, offering a scalable solution that integrates ERP, CRM, and ECommerce functionalities. NetSuite’s high degree of customization allows for specific business requirements, while its global capabilities support multi-currency and multinational operations, making it an ideal choice for companies with international reach. However, its complexity can pose challenges in setup and usage, and its high pricing and lengthy implementation period make it more suitable for larger businesses. For ECommerce, NetSuite integrates seamlessly with SuiteCommerce, offering real-time order management, inventory tracking, and financial reporting, making it highly suited for larger ECommerce businesses. Other key highlights include a seamless ERP integration and reporting features, which provide in-depth financial and operational insights.

Sage Accounting

Sage Accounting (previously known as Sage One) offers cloud-based accounting solutions aimed at small businesses. Known for its affordability and ease of use, Sage Accounting provides a simple interface and straightforward setup, making it accessible to small business owners. The software features, including invoicing, expense tracking, and financial reporting. However, it may lack the advanced features required by larger businesses, and its customer support has received mixed reviews. Additionally, Sage Accounting has fewer third-party integrations compared to its competitors. For ECommerce, it integrates with platforms like Shopify and WooCommerce, syncing sales data, automating invoices, and tracking expenses. This makes it moderately suited for small ECommerce businesses needing basic accounting features. This accounting software includes effective expense management and customizable invoicing options.

Wave Accounting

Wave Accounting is a free, cloud-based accounting software best suited for small businesses and freelancers. It offers core accounting features at no cost, which makes it highly attractive for budget-conscious users. Wave is user-friendly, easy to navigate & set up, and includes integrated features such as invoicing, receipt scanning, and personal finance management. However, it is not as feature-rich as paid software which offers limited customer support options and lacks scalability. Wave connects with ECommerce platforms like PayPal, Stripe, and Shopify, automating sales recording and expense tracking. This makes it well suited for small ECommerce businesses with basic accounting needs. Other noted features include its cost-effectiveness and the availability of a useful mobile app for on-the-go accounting.

Xero

Xero is a cloud-based accounting software that targets small to medium-sized businesses. It is known for its clean and intuitive interface, comprehensive features including invoicing, payroll, and inventory management, and its ability to connect with over 800 third-party apps. Xero also supports multi-currency operations, making it ideal for global businesses. However, its higher pricing for advanced features, occasional slow customer support, and steep learning curve can be drawbacks. Xero integrates with ECommerce platforms like Shopify, WooCommerce, and Amazon, automating sales data entry, managing inventory, and tracking expenses. These capabilities make it highly suited for small to medium ECommerce businesses.Xero also includes its high level of automation in bookkeeping tasks and the provision of real-time financial data and reporting.

ZOHO Books

Zoho Books is part of the Zoho suite of business applications, offering cloud-based accounting solutions with competitive pricing. It integrates seamlessly with other Zoho apps, providing a comprehensive feature set that includes invoicing, expense tracking, and inventory management. Zoho Books is user-friendly and highly customizable to fit specific business needs. However, its payroll features are limited to certain regions, and customer support has received mixed reviews. Additionally, it may not be suitable for very large businesses. For ECommerce, Zoho Books integrates with platforms like Shopify, WooCommerce, PayPal, and Stripe, automating sales tracking, inventory management, and financial data synchronisation. This makes it well suited for small to medium-sized ECommerce businesses. Zoho Books allows customizability and automated workflows that streamline accounting tasks.

Bench

Bench Accounting provides professional bookkeepers to manage finances. This full-service bookkeeping solution offers dedicated teams of bookkeepers, simple onboarding and setup, and detailed monthly financial reports. Bench’s customer support is highly rated, providing expert financial insights and advice. However, the service is more expensive than DIY software, offers less hands-on control over bookkeeping processes, and is primarily aimed at small businesses. Bench integrates with ECommerce platforms like Stripe, PayPal, and Shopify, managing sales data, expenses, and financial reporting professionally. This makes it ideal for small ECommerce businesses looking for outsourced bookkeeping. The other featured highlights include its hands-free approach to bookkeeping and the professional insights provided by dedicated bookkeepers.

Kashflow

KashFlow is a cloud accounting software designed for small businesses and sole traders. KashFlow automates repetitive accounting tasks, providing efficiency for its users. However, it is not as feature-rich as some competitors, and customer support has received mixed reviews. It also has fewer third-party integrations compared to other software. KashFlow integrates with ECommerce platforms like PayPal, GoCardless, and Shopify, automating sales data entry and managing financial transactions, making it moderately suited for small ECommerce businesses, most notably in the UK.

Free Agent

FreeAgent is a cloud-based accounting software aimed at freelancers, small businesses, and their accountants. It offers an intuitive and user-friendly interface that includes project management and time tracking features. FreeAgent’s customer support is highly rated, providing reliable assistance to its users. However, it lacks scalability as it may not be ideal for larger businesses due to its limited advanced features and higher pricing for advanced plans. Additionally, it has fewer ECommerce integrations compared to some competitors featured. FreeAgent integrates with ECommerce payment processors like PayPal and Stripe. It can automate sales tracking and expense management, making it moderately suited for freelancers and small ECommerce businesses.

How to choose the right accounting software for your ECommerce Business

Selecting the correct software requires a strategic approach. You need to match your business requirements by evaluating your operations, the number of transactions and your specific needs that the accounting software can cater to. It is advisable to try out the trials that these accounting software companies offer. This can allow you to find out if your business needs are met.

You need to also take into account the other factors that could affect your business like the responsiveness of their customer support, the scalability of these accounting software in the event you are planning on expanding your business.

Leveraging accounting software for business growth

The right accounting software does more than track numbers. You should be able to select software that can provide insights that will allow you to make more informed business decisions:

- Strategic Insights: The use of advanced reporting tools can help you understand business trends, profitability and guide you to make more informed business strategies.

- Integration: Effective software integration can automate tasks across platforms, reducing the workload and increasing efficiency.

Which one is the right on?

The right accounting software is pivotal in managing your ECommerce business, providing not just essential financial management but also strategic insights that can lead your business to grow. Choosing the right accounting software can empower you to make data-driven decisions with confidence. As your business evolves, scalable accounting solutions ensure that you can adapt without overhauling your entire financial system.

Whether you are a startup or an established business, investing in the right accounting software is a crucial step towards achieving financial stability and operational efficiency. In the ever-changing landscape of ECommerce, having a reliable and robust accounting system is not just a convenience, it’s a necessity for long-term success.The position of your business is not to only meet the challenges of today but to thrive in the opportunities of tomorrow.